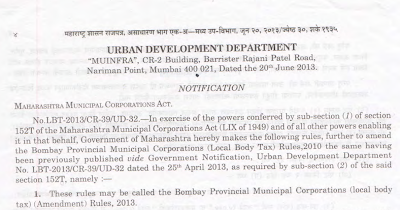

In a major relief to the trader community in the city, chief minister Prithviraj Chavan on Monday reiterated that the government will not introduce the Local Body Tax (LBT) in Mumbai from October 1.

Earlier, the government had set October 1 as the deadline to implement the new tax system in the city.

Leader of the opposition in the state legislative council Vinod Tawde, along with other legislators, had a meeting with Chavan over LBT in Vidhan Bhavan on Monday.

"The CM has assured legislators that the ruling DF government has no intention of bringing an ordinance to introduce LBT in Mumbai. He even assured the delegation that any decision on the new tax system will be taken only after a thorough discussion on the subject in both Houses of the state legislature," Tawde told the media after the meeting.

Earlier, the government had set October 1 as the deadline to implement the new tax system in the city.

Leader of the opposition in the state legislative council Vinod Tawde, along with other legislators, had a meeting with Chavan over LBT in Vidhan Bhavan on Monday.

"The CM has assured legislators that the ruling DF government has no intention of bringing an ordinance to introduce LBT in Mumbai. He even assured the delegation that any decision on the new tax system will be taken only after a thorough discussion on the subject in both Houses of the state legislature," Tawde told the media after the meeting.